One investment, a lifetime of benefits

An easy investment solution already available in your plan that prioritizes growth and helps secure your retirement with a lifetime of income.

While lifespans continue to increase, retirement income needs to last just as long. Lifetime income solutions can increase confidence that you won’t outlive your savings.

When you’re ready to start protecting your future retirement income:

This investment is offered within your retirement plan, making it easy to contribute in a variety of ways:

- All or part of your current investment can be reallocated; there is no minimum purchase amount.

- You can make ongoing contributions from your paycheck.

- You can transfer other eligible qualified retirement savings to your Nationwide Retirement plan and allocate the assets to this investment if you choose.

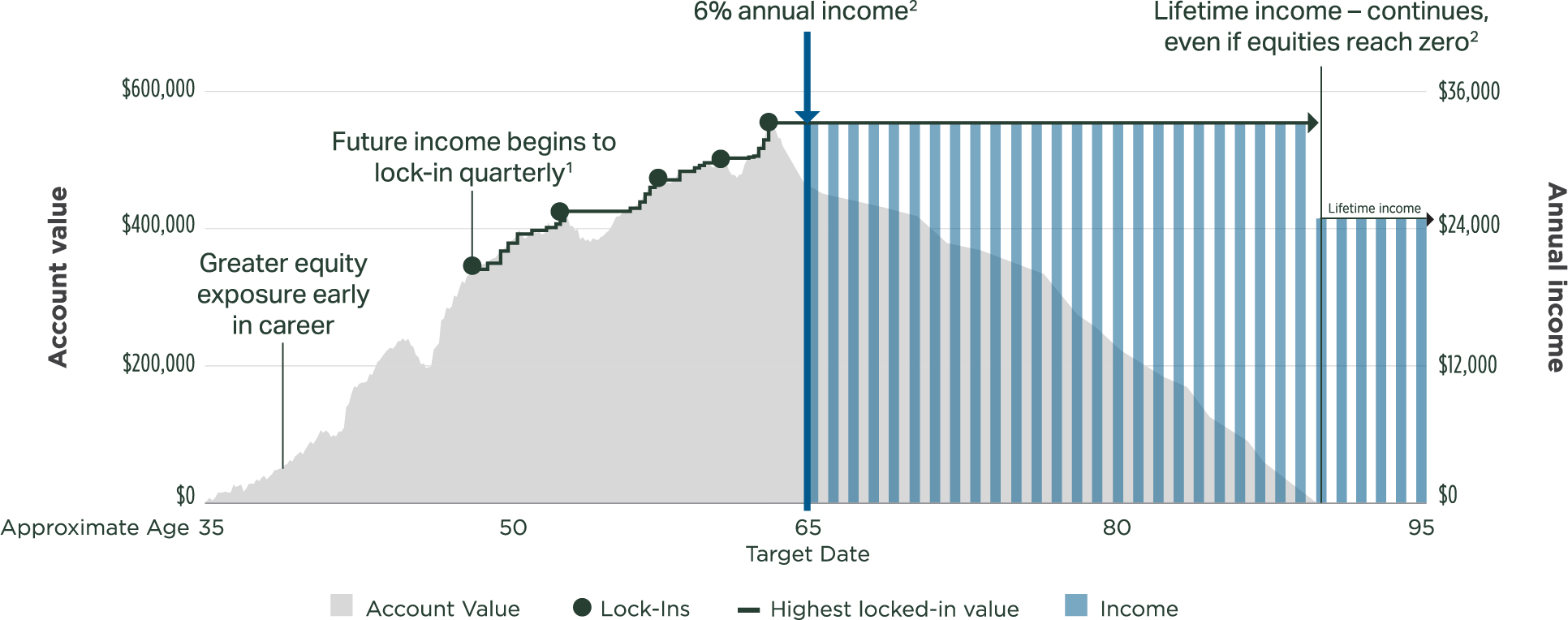

While maintaining growth opportunity, starting around age 47, the investment begins to lock-in your future income benefit:

- This establishes your projected income base — the value used to calculate your lifetime income.

- On the last business day of each calendar quarter and the last business day of the month prior to income activation, if investment gains result in a new maximum value, this is the value used to determine your new projected income base.

- The greater income base increases your expected future income benefit, and it is protected from market declines.

- And additional contributions increase your projected income base too (minus withdrawals)!

The investment may offer a joint income option, so you may have the choice to generate income for the lives of both you and your legal spouse. Under the joint income option, the future income benefit amount will be reduced, and will vary depending on the age differential between the participant and the joint beneficiary, as follows:

- Joint Beneficiary Age Differential ≤ 10 years: 90%

- Joint Beneficiary Age Differential > 10 years: 80%

This choice must be elected during an election period. This period runs for approximately 2 months, ending 10 business days prior to the target date. This election is irrevocable, even in the case of divorce. The reduced payments will be paid to the participant and/or the joint beneficiary until the death of both the participant and joint beneficiary. Any remaining investment balance will be paid to the participant’s beneficiary upon the death of the participant or the spouse’s beneficiary as applicable if the joint income option was elected.

You can make changes at any time. The investment is fully liquid with no holding periods, and there are no termination fees or transfer fees for withdrawals or reallocations. Partial exchanges out of the investment and into another investment will decrease the amount on which your lifetime income benefit will be calculated and lessen your overall income benefit. A full exchange out of the investment will forfeit your lifetime income benefit.

Should you change employers or if your current employer removes the Investment from the plan lineup, you may be able to roll over your balance to another retirement plan that offers the Investment, or to an IRA product that offers an income guarantee. Any rollover solution, whether or not it offers a guaranteed income option, may have different investments, fees and features. Rollover options are subject to the provisions of the plan document.

There are no annual contribution limits to the investment beyond the annual IRS limits for all retirement plans, but there are a few other restrictions:

- There is a $7.5 million limit on total contributions, including any rollovers or transfers into your plan account.

- Contributions are restricted at income activation, or the target date.

Income: At the target date, the investment automatically generates a target of 6% of your income base as annual income. If the equity portion of the fund ever reaches zero, the annual income benefit will adjust from 6% to 4.5% (targeted)2 of your income base and will continue for the rest of your life.

Returns: Your account will continue to be invested and earn returns based on the fund's performance, which may be more or less than the income amount.